400,000 visitors from 95 countries, nearly 1000 speakers and 744 exhibitors gathered at the new IAA Mobility last week. Among them were car manufacturers, important players of the tech industry, numerous relevant companies of the supply industry and suppliers of micromobility products. As every time, we from magility were again active on site.

The new concept

This year, the IAA Mobility presented itself in Munich for the first time in a completely new way. Very ambitious, hybrid in presence and online version, as well as in a B2B and a B2C version. The B2B section was located on the exhibition grounds themselves, while the B2C area was placed in the center of the city. Many areas could be visited free of charge on Munich’s most popular squares, even without a ticket. Those who were not there in person were able to experience the show digitally via IAA Mobility’s new virtual platform.

The demonstrators

In particular, the squares in the city were protected by massive police presence. There has not been a larger police contingent in Germany since the 2017 G20 Summit in Hamburg. Numerous demonstrators gathered at different squares and demanded a turn away from the still car-dominated traffic policy. They stood up for pedestrian, bicycle and local traffic, abseiled from highway bridges, organized a bicycle star ride as well as pedestrian demonstrations or took part in a so-called protest camp on the Theresienwiese. Demonstrators accused the makers of the IAA Mobility of being nothing more than a platform for the image polish of politics and business.

Our impression – magility on site

During our walk around the fair, we could already clearly see the transition from a pure car show to a mobility exhibition. Different vehicle solutions and forms of mobility have found their way into the trade fair. The new IAA Mobility is no longer a pure car show where OEMs present their cars with powerful combustion engines. Only a few vehicles with combustion engines were to be found at the fair, but unfortunately also almost no exhibitors from abroad. The IAA Mobility is supposed to become a networking event and a platform for cooperation as well as for new business models, micro-mobility and urban policy. Under one roof, or one sky, many players came together to shape the mobility of the future.

In her opening speech at the IAA, Chancellor Merkel spoke of a real quantum leap compared to the last IAA. The networking of all forms of mobility was clearly the focus. In addition to the automakers, numerous suppliers, tech startups, bicycle brands and other micro-mobility providers with new offerings bustled around the exhibition areas. On different stages, there were discussions and lectures about the new forms of mobility, and everything related to them. It was also about the cities of the future, about cyber security, about traffic concepts and, of course, about the further advancement of networking.

A tangible vision of the city of the future, climate-neutral, without noise and congestion and with a multimodal and safe traffic concept, has not yet emerged for us at the fair. Due to the very ambitious, future-oriented and decentralized concept and due to the integration of the numerous forms of locomotion, one sometimes felt a bit lost in the large halls or on the streets. The path taken by the makers of the IAA Mobility is a first small step in the right direction and, from magility’s point of view, has great potential for the future. As is well known, transformation away from the tried-and-true to the experimental new never runs smoothly and requires support from experts who can combine the old and the new in a meaningful way.

The biggest weakness of the current concept is the inadequate implementation of the B2B concept. As in the old days, almost all exhibitors have sent pure sales teams to the trade show booths. However, there is a lack of qualified developers and buyers to bring the B2B concept to real life.

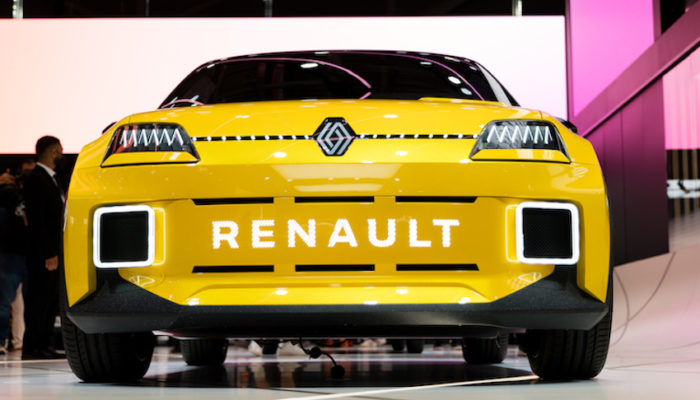

The car manufacturers

Electric vehicles clearly dominate the show floor at IAA Mobility. The industry has realized that it needs to rethink and the politically prescribed framework conditions seem to be taking effect. We were able to find only a few vehicles with classic combustion engines at the IAA. This effect is already reflected in the registration statistics of the German Federal Motor Transport Authority (KBA, 2020), which records a total of 25% of registrations for the e-vehicle and hybrid segments. This is almost on a par with diesel (28%), while gasoline still clearly leads with 47% of registrations. The OEMs are therefore perfectly capable of meeting current demand.

The principle of “more sustainable, smarter, shared economy” is increasingly replacing the old principle of “faster, stronger and wider”. At the IAA Mobility, this development has not yet taken hold in the OEM passenger cars on display. For potential buyers from the cross-section of the German population, the range of offers there is still inadequate. According to a study by Statista on the willingness of the German population to spend on the purchase of a passenger car in 2020, only about 6% of the population who planned to buy a new car in 2020 wanted to invest more than €25,000 in this purchase.

The only car at the show with a purchase price below €25,000 was VW’s ID.Life, although according to Volkswagen brand boss Ralf Brandstätter, it will not be available on the market until 2025. So we looked in vain for available electric vehicles for the mass market at the IAA Mobility, as well as hydrogen-powered vehicles.

Internationality was sorely missed at the IAA and should be restored at subsequent trade shows. In addition, the IAA Mobility does not cover the complete range of mobility, because motorcycles, air cabs, hyperloops, electric planes, supersonic aircrafts and spaceships are missing.

Our conclusion: IAA Mobility 2021 was, as always, exciting and at the same time already very different from the past. But for it to be sustainable, it needs to change a lot more. The direction is right, the design still needs significant corrective loops.

The suppliers

The suppliers moved much more into the center of attention at the IAA Mobility. The major suppliers (Tier1) met the automakers on an equal footing. This was quite different at the “old” IAA. Here, a clear shift is visible and the industry “behind” it is more visible. Among suppliers, too, the focus is clearly on electromobility and alternative drive technologies. Bosch, for example, announced at the IAA Mobility that electromobility would become the core business for the company in the future and presented the newly developed “eAxis“, which combines power electronics, electric motor and transmission into a single unit. Continental and Schaeffler also showed innovations around the topic of alternative drives at the trade show.

At the press conference, Wolf-Henning Scheider, Chief Executive Officer of the ZF Group, presented the ZF strategy “Next Generation Mobility. NOW“. He also presented the so-called “Modular eDrive Kit“, a modular construction kit consisting of coordinated components which, in addition to e-motors, also offers inverters, software, and various transmission options. According to Scheider, it bundles the entire expertise of the ZF e-mobility team in system solutions, components and software control in a flexible and modular platform. The consistent modular approach of the eDrive Kit is the optimal complement to the platform strategy of vehicle manufacturers. With the modular drive solution for purely electric passenger cars, ZF promises up to 50 percent shorter development times as well as high maturity levels. From compact cars to the premium segment, everything can be mapped.

The ZF example shows, as do Huawei, Schaeffler, Bosch, Tesla, and others, that the intelligence of future vehicles will be determined by a few, extremely powerful central computers such as the ZF ProAI. According to ZF, the ZF ProAI is the most flexible, scalable, and powerful automotive-grade supercomputer for the automotive industry, effectively becoming the source of vehicle intelligence.

The changeover process from conventional driveline technology to electromobility represents a massive qualification effort in the coming years, also for suppliers, who will have to adapt their services and products to the new requirements. From magility’s point of view, some suppliers are already well ahead of the vehicle manufacturers, while others will not survive this next evolutionary step.

The startups

Startups were much more in focus at the IAA Mobility compared to the last IAA. The startup booths were centrally located next to the big players in the industry and therefore very accessible to trade show visitors. They had the opportunity to network with investors, international partners and political representatives at the numerous networking events and to participate in master classes, discussion panels and lectures. The IAA Mobility Founders Day – a networking event – also reached progressive target groups of the IAA. Many of the most exciting developments came not from the established manufacturers, for example, but precisely from these new young companies and the startups. For example, Johann Jungwirth, Vice President of Mobility-as-a-Service (MaaS) at Mobileye, announced a small sensation from the field of autonomous driving. Starting in 2022, a robot cab service is to be offered in Munich together with the car rental company Sixt, which is to operate without a safety driver. Approval has already been applied for. Tech startups are ahead of established providers, primarily due to their faster development cycles. Many startups from the ADAS sector were also represented at the show. So was Cognata, an Israeli company that offers full product lifecycle simulation for developers of ADAS and autonomous vehicles. We will report on these and other interesting startups at the IAA and their high-tech developments in another article.

Micromobility at the IAA

Cars were not the only focus of attention at this year’s IAA. Micromobility providers also got involved in the trade show action for the first time. Bicycles are in vogue, and even classic car manufacturers such as Porsche are getting involved in the micromobility-market: In cooperation with German bicycle manufacturer Storck Bicycle, Porsche has launched a new brand called Cyklaer. This brand offers fast e-bikes at Porsche’s price level. BMW is active in the cargo bike sector with its “Dynamic Cargo” concept, and VW is also involved with its “e-Bike Cargo” cargo bike, which is even due to be launched this year. Young companies and startups are also getting involved in the micromobility sector at this year’s IAA Mobility. We will report on this in a separate article.

Our conclusion

The path to climate-neutral mobility that is affordable and available to all is visibly progressing, even if there are still some long-established views and behaviors to be rethought along the way! The IAA Mobility has picked up on this trend and given a starting signal with the new concept. The design can be further developed and can move in a promising direction. This year, IAA Mobility was clearly focused on e-drives. ADAS and e-mobility topics were definitely the focus of the show. Suppliers of micro-mobility-products also made their mark at the show. It was also clear to us that the convergence of industries will play an even more important role in the future. Platform providers are now playing a major role in the automotive industry. Huawei in particular stood out to us with its end-to-end solution from the cloud to the vehicle architecture. So telecommunications companies are no longer just appearing on the sidelines in the automotive market. They are right in the middle of the action, and car manufacturers will have to dress warmly. For the next IAA in 2023, we at magility expect the topic of autonomous driving to move further into the spotlight of the trade show.

magility on side

All in all, we look back on a very interesting trade fair and are already looking forward to the exciting development steps that will (have to) be taken through the mobility transformation by 2023. We are enthusiastically supporting the startups from our network in placing their high-tech developments in the right place at the right time here in Europe. For the industrial companies, we evaluate and review new innovative business models and accompany them during integration and market launch. With our experts in the field of electromobility and alternative drives, we also monitor this submarket. If you have any questions, please do not hesitate to contact us.