The digital transformation, combined with a realignment based on sustainability goals, increases companies’ chances of economic success: companies can increase their profitability in the long term through this networking and thus increase the value of the company. In addition to sustainability goals, the achievement of defined ESG targets becomes just as important a success factor. In this article, we clarify what ESG means, what the United Nations’ Agenda 2030 with its 17 Sustainable Development Goals, the so-called SDGs, has to do with it, what ESG means for companies and investors, and how to develop a sustainable ESG approach for business.

The automotive industry is changing due to innovations in electrification, autonomous driving and smart mobility. With transportation estimated to account for between 15% and 25% of global carbon emissions, and road vehicles responsible for nearly three-quarters of that share, the environmental motivation is obvious.

The shift to more electrified and autonomous vehicles will continue to change not only traditional working conditions in the automotive industry, but also the direction of automakers.

Corporate management in the automotive industry must be characterized by technological and business expertise, in-depth industry knowledge and goal-oriented handling of strategic partnerships in order to meet the challenges of the future. In this context, the ESG megatrend is of fundamental importance.

What is ESG?

By definition, ESG reporting is the disclosure of data that explains a company’s actions and added value in three areas: environmental, social and corporate governance (principles of corporate management). ESG is the generic term for sustainable and responsible corporate governance. It is a set of guidelines that consider environmental, social and governance factors in addition to financial factors when making investment decisions. It is also a process for assessing how companies perform on each of the E, S and G factors to ultimately determine whether investments are compatible in terms of the guidelines.

What does the E in ESG stand for?

The E in ESG stands for Environmental, and describes the ecological impact of a company’s operations. It is analyzed how its activities affect the environment and how it deals with environmental risks. This applies both to direct operations and to the entire value chain, examples of which include shortages of resources and their management, conservation of natural resources, treatment of people and animals, and greenhouse gas emissions.

What does the S in ESG stand for?

The S in ESG stands for Social Criteria. The strengths and weaknesses of companies’ actions in their social environment are analyzed and assessed. This includes, among other things, the relationship with employees, suppliers, customers and the community level. The assessment ise.g. based on the following criteria: Working conditions, health and safety, social interaction, activities in conflict regions, and diversity.

What does the G in ESG stand for?

The G in ESG stands for Governance, i.e. corporate governance, and deals with its design, particularly in the areas of accounting, executive compensation models, internal control system (ICS), gender equality and, where applicable, shareholders’ rights. Investors and the public are interested in maximum transparency of corporate processes, and governance provides the necessary basis for trust.

Hand in hand with the ESG approach: The 17 SDG goals

Closely linked to the topic of ESG is also the 2030 Agenda for Sustainable Development, which was adopted by all member states of the United Nations in 2015. It is a shared approach to peace and prosperity for people and the planet, now and in the future. At its core are the 17 Sustainable Development Goals (SDGs), which are an urgent call to action by all countries – developed and developing – as part of a global partnership. They recognize that eliminating poverty and other deprivations must go hand in hand with strategies to improve health and education, reduce inequality, and spur economic growth – all while combating climate change and working to protect our oceans and forests.

Today, the Sustainable Development Goals Division (DSDG) in the United Nations Department of Economic and Social Affairs (UNDESA) provides support in terms of content and capacity building for the SDGs and related thematic issues (e.g. water, energy, climate, urbanization, oceans, science, transport, and technology), the Global Sustainable Development Report (GSDR), partnerships, and for small island developing states. The DSDG plays a key role in evaluating the United Nations’ system-wide implementation of the 2030 Agenda, as well as in advocacy and outreach related to the SDGs. To make the 2030 Agenda a reality, broad support for the SDGs must translate into strong commitment by all stakeholders to implement the global goals. The DSDG is designed to help to foster this commitment.

These are the following goals that go hand in hand with the ESG factors:

© Backwoodsdesign-stock.adobe.com

Who cares wins: The importance of ESG for companies and investors

Investing in ESG already began in the 1960s. ESG investing evolved from so-called “socially responsible investing” (SRI), which excluded capital investments in industries associated with business activities such as tobacco, weapons or goods from conflict regions. The term ESG was established by former UN Secretary General Kofi Annan in 2004 and led to the first “Who cares Wins” study in 2005, developed with the world’s largest institutional investors and banks.

Today, ESG is growing and evolving rapidly as many investors seek to incorporate ESG factors into the investment process. Similarly, the Portfolio Decarbonization Coalition, a United Nations-sponsored group of 27 mainly European institutional investors and asset managers controlling $3.2 trillion in assets, has pledged $600 billion to fund green projects and investments.

On the legal side, European regulations are pushing for effective implementation of ESG factors in the financial sector and everywhere else. The ESG framework is being pushed in the EU because it is a mechanism to support the Green Deal and ensure the implementation of a more sustainable economy. ESG factors will play an increasingly important role in evaluating companies, not only for investors but also for consumers and stakeholders. Companies are becoming increasingly aware that they must manage their environmental impacts in innovative ways to remain successful. Sustainability is the new ideal, and the development of sophisticated methods for assessing ESG activities and their impacts is key to its realization.

Magility’s ESG approach – goals, strategy and transformation

For companies to stay ahead of regulations and the competition and reap all the benefits, they need to integrate the ESG approach into the core of their corporate philosophy.

What is the best approach? Magility offers them a methodology that takes sustainability and ESG factors into account. It is recommended to incorporate ESG into the corporate philosophy from the outset and align corporate objectives accordingly. This allows companies to be more diversified and equal in the way they operate, promote the health and well-being of employees, and in this way also generate a positive impact on their local environment and beyond that in general.

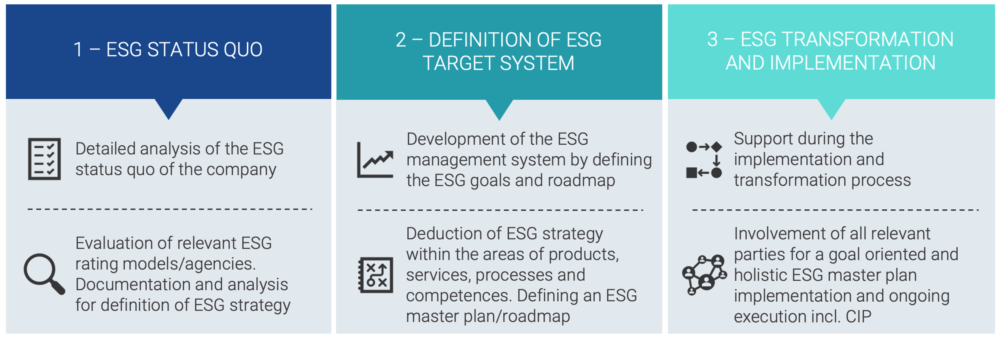

Magility’s ESG consulting approach consists of 3 phases:

© Magility GmbH

The ESG control loop – your business success after implementation

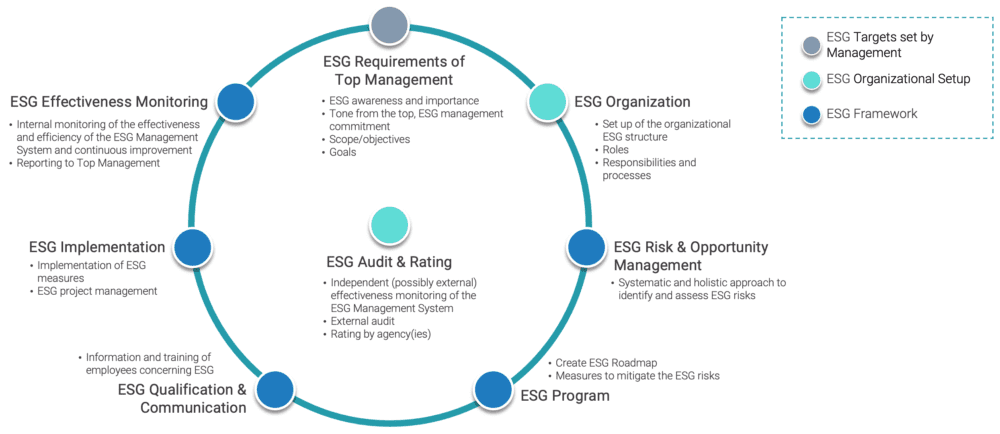

Magility uses the following control loop for sustainable awareness and management of ESG activities:

© Magility GmbH

As a result of an implementation, your company will be enabled to play in the top league of sustainable companies.

In addition, such implementation can also have a positive impact on the operating result of your company. It depends very much on how the different levers and measures are prioritized and implemented. With our experience we can support you in making the right choice and accompany you during the implementation.

If you want to position your company sustainably for the future and our implementation method has aroused your curiosity, we look forward to hearing from you.

Start your ESG reporting with magility. Feel free to contact our CEO Dr. Michael Müller for more information and follow us on LinkedIn as well. We are looking forward to it!