Path to climate neutrality

Many efforts are needed on the road to carbon neutrality. Companies are under increasing pressure to address environmental, social and governance (ESG) issues and define sustainability targets. Read everything you need to know about Carbon Crediting in our recent blog article.

A decarbonisation strategy for climate protection

Beyond their ethical implications, ESG measures and, as a consequence, good ESG ratings have become a crucial competitive factor for companies.

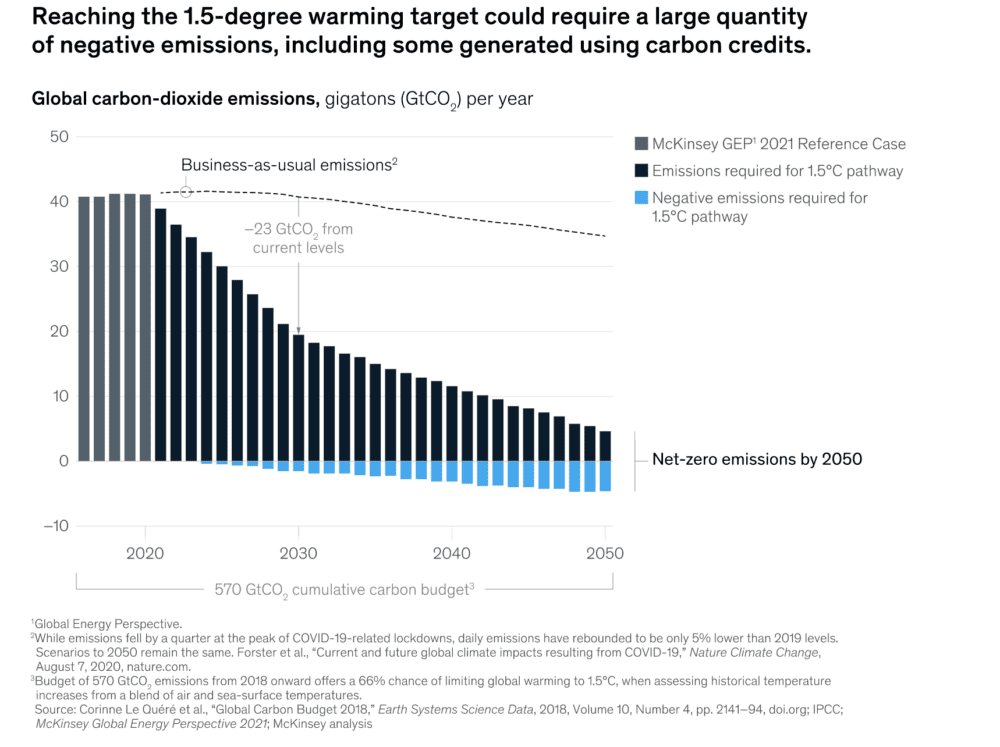

With comprehensive sustainability reporting set to become mandatory very soon, companies are recognising the relevance of managing their environmental impact, particularly in relation to carbon emissions. According to experts, in order to achieve the 1.5-degree target for CO2 emissions proclaimed in Paris in 2015, global greenhouse gas emissions would have to be reduced by 50 per cent of current levels by 2030 and reduced to net zero by 2050.

Source: McKinsey, 2021

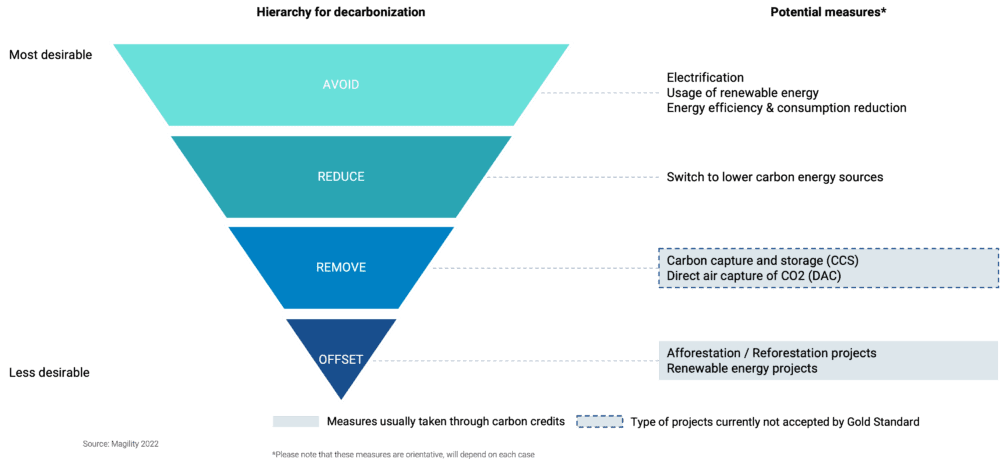

The harmful effects of these emissions on the global climate have led companies and organisations to re-evaluate their operations, adapt to greener practices and develop comprehensive strategies to reduce their carbon footprint, such as building renewable energy facilities. In such a decarbonisation strategy, one ideally follows the principle of Avoid – Reduce – Remove – Offset.

Source: Magility, 2022

However, there are also emissions that are difficult to reduce or even completely avoid, especially in manufacturing companies. For these companies, it is compensation instead of reduction. This is where the so-called carbon credits come into play.

Carbon Credits and Carbon Allowances

Carbon credits are used by companies to offset emissions that they cannot avoid. This so-called Voluntary Carbon Market (VCM), i.e. voluntary implementation, contrasts with Regulated Emission Trading Systems (ETS), which are used by various countries to encourage companies to reduce emissions. In the ETS, the amount of CO2 emissions allowed is limited. Companies that emit fewer emissions than allowed can sell these as so-called carbon allowances – but if they emit more than allowed, they must purchase corresponding allowances.

By purchasing carbon credits and thus financing certified climate protection projects, companies, governments, but also individuals can reduce, remove or offset their emissions. One carbon credit corresponds to the removal of one metric tonne of CO2.

Since 2005, the European compliance market has included CO2 emissions from industry, energy and aviation, the sectors with the highest current emissions in the EU. It is managed according to the “cap and trade” principle, which reduces the amount of carbon allowances available each year, thus increasing prices and creating incentives to reduce. In 2022, the total number of allowances in circulation (TNAC) was over 1.1 million, generating €38.8 billion in sales. The number of annual allowances is continuously being reduced in order to achieve further price increases.

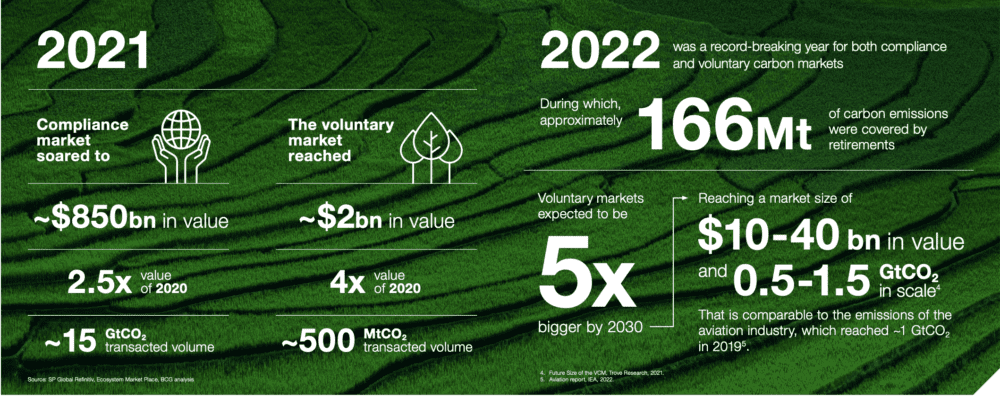

The VCM which started in 1996 with the first so-called REDD projects (Reducing Emissions from Deforestation and Forest Destruction) has rapidly developed into a million-dollar business that could potentially be worth almost 10-40 billion dollars by 2030.

Source: Shell and BCG, 2022

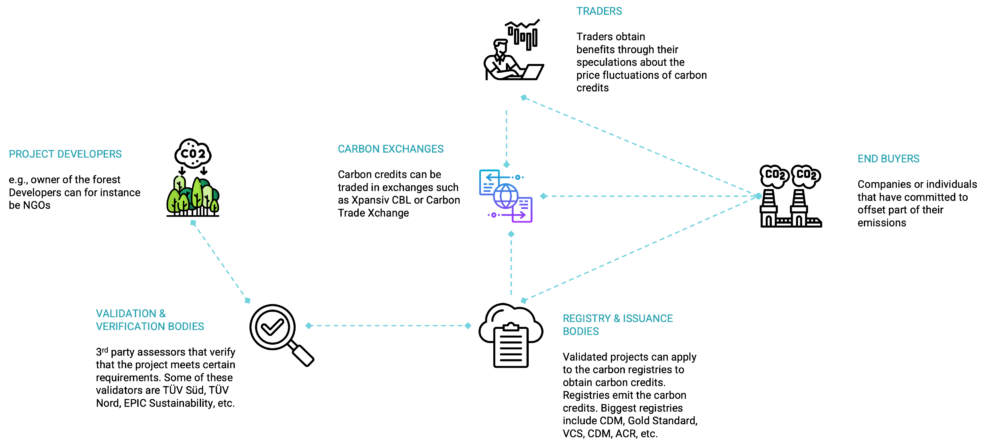

Carbon Crediting Ecosystem

Currently, projects to offset CO2 are carried out by independent private project developers. Both the projects themselves and the tonnes of CO2 saved as a result are verified by external auditors. These auditors apply various standards, such as the Gold Standard or the Verra Verified Carbon Standard, to quantify and verify the savings potential of the projects. After verification, the corresponding number of credits is registered in the so-called carbon registries of the respective standards. Buyers can then purchase the credits directly from the project developers, via the registries or from other traders.

Source: Magility, 2022

What are the disadvantages of carbon crediting so far?

Since the market for carbon credits and the associated projects is not yet very strongly regulated, there is a danger that companies will only engage in emissions reduction for the sake of appearances, invest in projects that are not environmentally compatible or simply engage in greenwashing:

- Compensation measures, such as reforestation of the rainforest, are relatively short-term measures – which is exactly “only” over the lifetime of a tree. Nevertheless, in most cases such measures also create other benefits for the environment.

- In some cases, (re)afforestation does not take into account the biodiversity of the surrounding area, but focuses only on factors such as rapid tree growth. This in turn promotes the spread of monocultures.

- The prices for carbon credits were still very volatile in the past. This creates the risk that investments for future projects are set too low.

- Some companies could simply buy carbon credits for a clear conscience – and at the same time do nothing to reduce their emissions.

- In the context of impact investing, i.e. investing in sustainable projects, “additionality” is key. This means, if a project or an investment creates a reduction in emissions, this must be in addition to the emission reductions that would have been achieved even without the implementation of the project. However, assumptions about what emission reductions would have been achieved even without a specific project are often difficult, if not impossible. For example, would the solar plants in a rural area of India have been built only because of the investment through carbon credits or would they have been built anyway? Would a forest in Colombia have been reforested even without carbon crediting financing? Although the registries are trying to ensure additionality, it will probably be a while before there is real clarity on this.

What does the future hold for carbon crediting?

Under Article 6, the Paris Climate Agreement allows the carbon crediting system to offset emissions, as well as trading carbon allowances. The current Clean Development Mechanism (CDM) will be replaced by a new registration option for projects. It currently remains uncertain whether and to what extent this will affect the VCM. Although standardisation is still under development, carbon credits will undoubtedly be an important factor in reducing emissions and a considerable currency. However, to become completely carbon neutral, more than just offsetting is needed, but an intelligent and holistic decarbonisation strategy.

At magility, we consider this decarbonisation strategy a fundamental part of our ESG management system. We help you to implement your individual strategy into your company.

When does your sustainable future start? Contact us for more information!