Sustainable and responsible corporate governance is increasingly determining corporate actions in the boardrooms. A good ESG rating will have a significant impact on corporate success in the future, and the topic of ESG is receiving correspondingly strong attention in the media. Since 2017, large companies, insurance companies and banks have been obliged to report on sustainability. Based on the EU’s Non-Financial Reporting Directive (NFRD), non-financial reporting is usually included in the annual financial statements and comprises information and lists of commitments to environmental protection and nature conservation, social responsibility, human rights, dealing with corruption and ensuring diversity on supervisory boards and management floors.

However, as part of the EU Green Deal and the EU Action Plan “Financing Sustainable Growth”, the NFRD was fundamentally revised and expanded to make the presentation of information more comparable and transparent and to clarify its relevance. The draft of the new “Corporate Sustainability Reporting Directive (CSRD)”, which has been available since 2021, was adopted by the European Council on November 28, 2022.

In this article, we summarize the latest information on the new sustainability reporting, answer the most important questions and provide valuable tips on how you can prepare for the implementation of the CSRD (Corporate Sustainability Reporting Directive) in your company.

What is the role of the CSRD?

According to the Commission, the Corporate Sustainability Reporting Directive is intended to ensure “that adequate, accessible information is available on the risks for companies in connection with sustainability aspects and on the impact of the companies themselves on people and the environment.” The goal is to create comparable and reliable reporting, with an equally weighted non-financial part added to its traditional financial-oriented part in the future. In addition, all of a company’s business relationships and supply chains will be subject to sustainability scrutiny. Until now, existing legislation on the disclosure of non-financial information has often been considered inadequate or even unreliable. The new CSRD initiative will fundamentally change the scope and nature of sustainability reporting.

In order to achieve the European Commission’s goal, companies will have to take care of two things in the future:

- The application of new ESG accounting standards, the European Sustainability Reporting Standards (ESRS), and

- the independent auditing and certification by an auditor of the reporting based on these standards.

Sustainability information must also be accessible digitally.

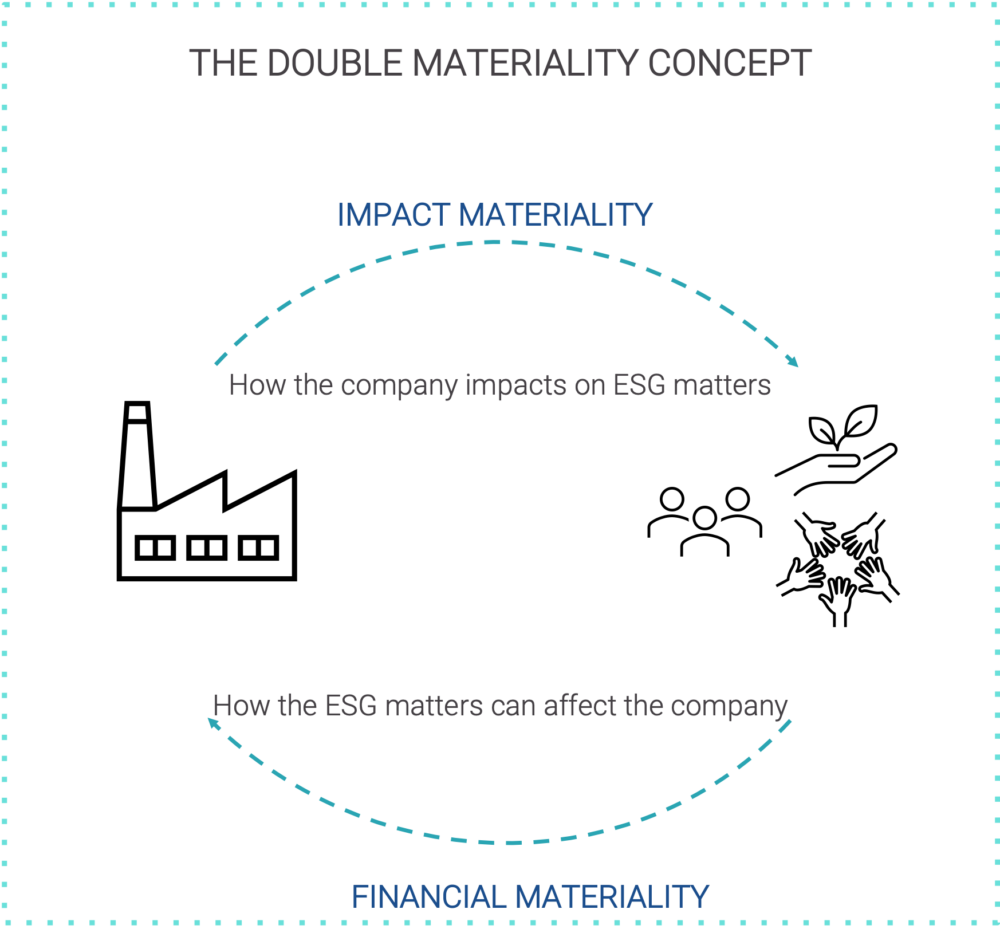

While the CSRD provides the formal requirements for reporting, the ESRS define the content. The ESRS take up existing regulations, such as the standards of the GRI (Global Reporting Initiative) and the SASB (Sustainability Accounting Standards Board) and the rules of the TCFD (Task force on Climate-related Financial Disclosures), but at the same time make the content clearer. New, uniform rules for the EU are thus defined, including the concept of double materiality. Specificially, this means that the impact of a company’s own activities on the environment is no longer the only factor to be considered. Equally, how ESG aspects affect the company and its strategies and activities must now also be taken into account.

Source: Magility GmbH

What are the advantages of the new reporting directive?

The advantages of this new transparency and uniformity are obvious. Stakeholders, such as investors, but also consumers, should find their own decision-making easier, for example with regard to investments or purchases that are also based on sustainability aspects. But it will also encourage and enable companies to give their ESG measures a bigger stage and thus tap into new customer groups and investors.

As non-EU companies are now also required to report for the first time, the European Commission’s initiative strengthens equal opportunities in the EU. For small and medium-sized enterprises (SMEs), this offers a major incentive to also voluntarily expand their reporting to include sustainability topics. The EU is thus laying the foundation for a global standard of sustainability reporting and wants to put an end to greenwashing.

Which companies will be subject to the new directive in the future?

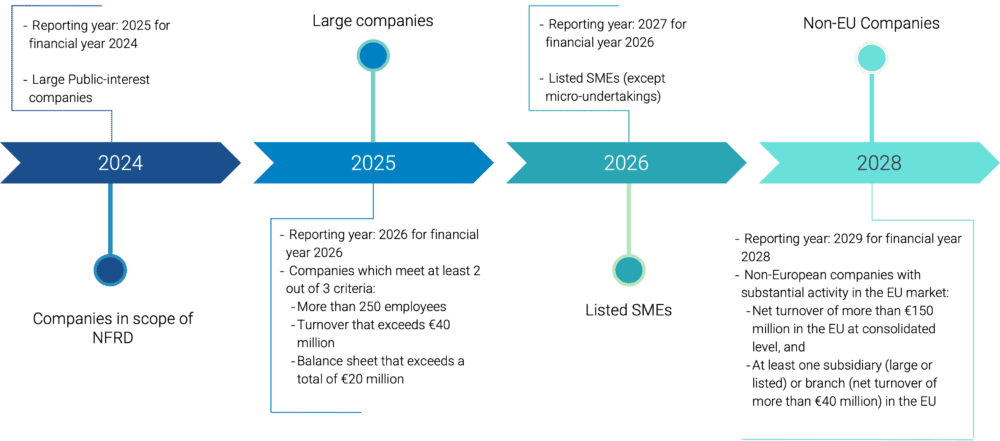

As things stand at present, the audit obligation will apply to the first companies as early as 2025 (reporting year 2024), with others to follow by 2029.

Source: Magility GmbH

In total, around 50,000 companies in the EU and 15,000 in Germany alone will be affected by the CSRD regulations in the future. Compared to the current NFRD EU Directive 2014/95/EU, the new directive also changes the scope and timing of the reporting obligations. Whereas companies previously had to report on environmental protection, social responsibility, anti-corruption and bribery as well as diversity on company boards, the CSRD goes even further: in addition to the “double materiality” already mentioned, further forward-looking information including the setting of targets as well as documentation of progress will be required in the future. Information on intangible assets must also be disclosed. As a matter of principle, reporting must comply with the Sustainable Finance Disclosure Regulations (SFDR) and the EU tax directives.

How do I know what to report about?

How exactly the corporate sustainability reporting directive is now implemented is defined by the ESG accounting standards, the ESRS. The current drafts of the requirements can be found on the website of EFRAG (European Financial Reporting Advisory Group).

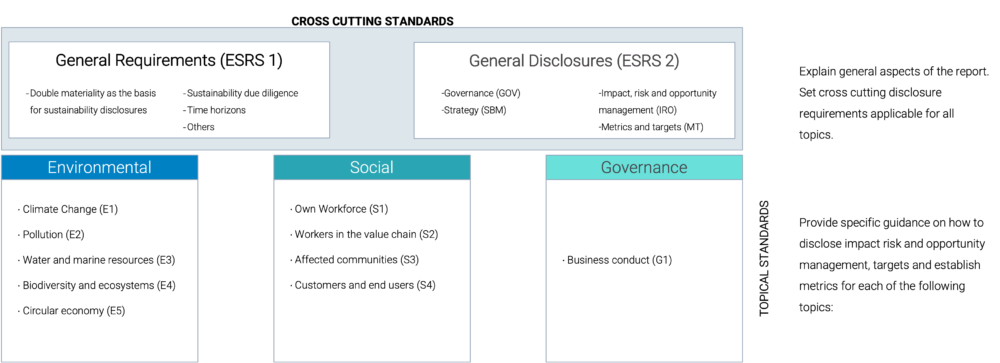

Source: Magility GmbH

ESRS 1 and ESRS 2, the General Information and Overarching Standards sections, describe and explain general aspects of the report that apply to all topics and areas. They specify how to report on the individual topics.

ESRS 2 examines strategy and business model in relation to sustainability, as well as corporate governance and organization and sustainability-related impacts, risks and opportunities. Finally, this section deals with concrete measures, allocation of resources, and key performance indicators.

The Environmental (ESRS E1 to E5), Social (ESRS S1 to S4) and Governance (ESRS G1) sections contain ten topic-specific standards, for example on climate change, environmental pollution, employee rights, corporate governance and business ethics. Which of these topics are relevant to a company is already determined in the analysis of dual materiality (ESRS 1). The standards set out in detail here what must be reported specifically on the individual topics.

In summary: ESRS 1 defines the how of the sustainability report, ESRS 2 and the topic-specific segments define the what, i.e. the contents of the report.

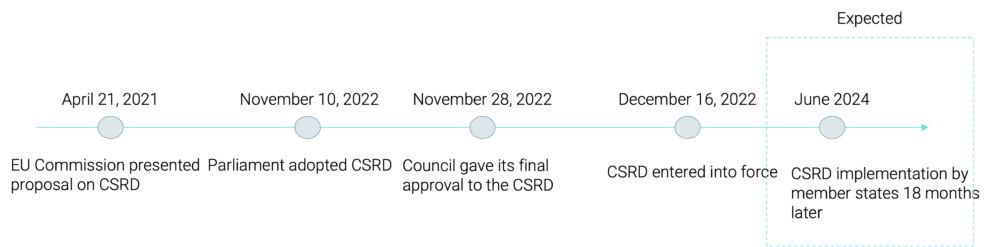

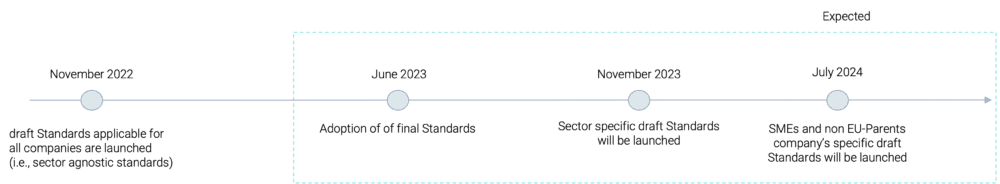

The timeline around the implementation of the CSRD at EU level

EFRAG, which submits fully developed draft standards or amendments to them to the EU for EU sustainability reporting, published the first official drafts of the new standard at the end of April 2022. On November 10, 2022, the EU Parliament adopted the reporting proposals for large capital market-oriented companies and equivalent trading partnerships, which were subsequently finalized by the European Commission. The new CSRD then officially came into force on December 19, 2022.

Source: Magility GmbH

From mid-2024, the new regulations will then also be implemented in national law at EU level. For companies, this means that the first annual reports will have to be published in accordance with the new uniform requirements for sustainability reporting as early as January 2025.

The ESRS currently still have draft status – but the standards are to be further defined and extended to sector-specific standards as early as November 2023.

Source: Magility GmbH

No time to lose: magility supports you with your sustainability reporting

The additional burden imposed by the new EU requirements is noticeable for all affected companies, but it is particularly high for small and medium-sized enterprises. They often find it difficult to track their supply and value chains and therefore cannot provide the required information in full. Despite the three-year transition period granted to SMEs, we strongly recommend dealing with the new requirements immediately and developing an implementation strategy now. On the one hand, because the conception of a new reporting already takes a lot of time from a purely technical point of view. On the other hand, companies and their management must be aware that this is a far-reaching change that cannot be anchored in the corporate culture overnight.

Magility supports you in the implementation of the Corporate Sustainability Reporting Directive and the preparation and creation of your sustainability reporting. With our ESG Management System, we help you successfully navigate through the ESRS and set your sustainability targets.

– We check if and when CSRD becomes relevant for your company

– Together we develop a viable ESG management system:

- Definition of material impacts

- Structuring of ESG measures in an ESG program

- Definition of the relevant goals – SDGs (Sustainable Development Goals)

- Agreeing on an ESG governance model

- Defining the plan for ESG reporting and audits

Sustainability is a must-have, no longer a nice-to-have! We support you in this. Contact our magility ESG experts!